With our UK Limited company formations, we offer a Same Day Guaranteed Incorporation service.

Same Day Guaranteed Incorporations must be submitted before 15:00pm GMT. Our price for this service is £35.00 and can be selected during the incorporation process.

If a Same Day Incorporation is requested on a non-working day or if the company is submitted after the cut-off time, it may still be incorporated the Same Day. This is dependent on the Company Registry

If the company is not incorporated that day, then it will be given top priority with the registry on the next working day.

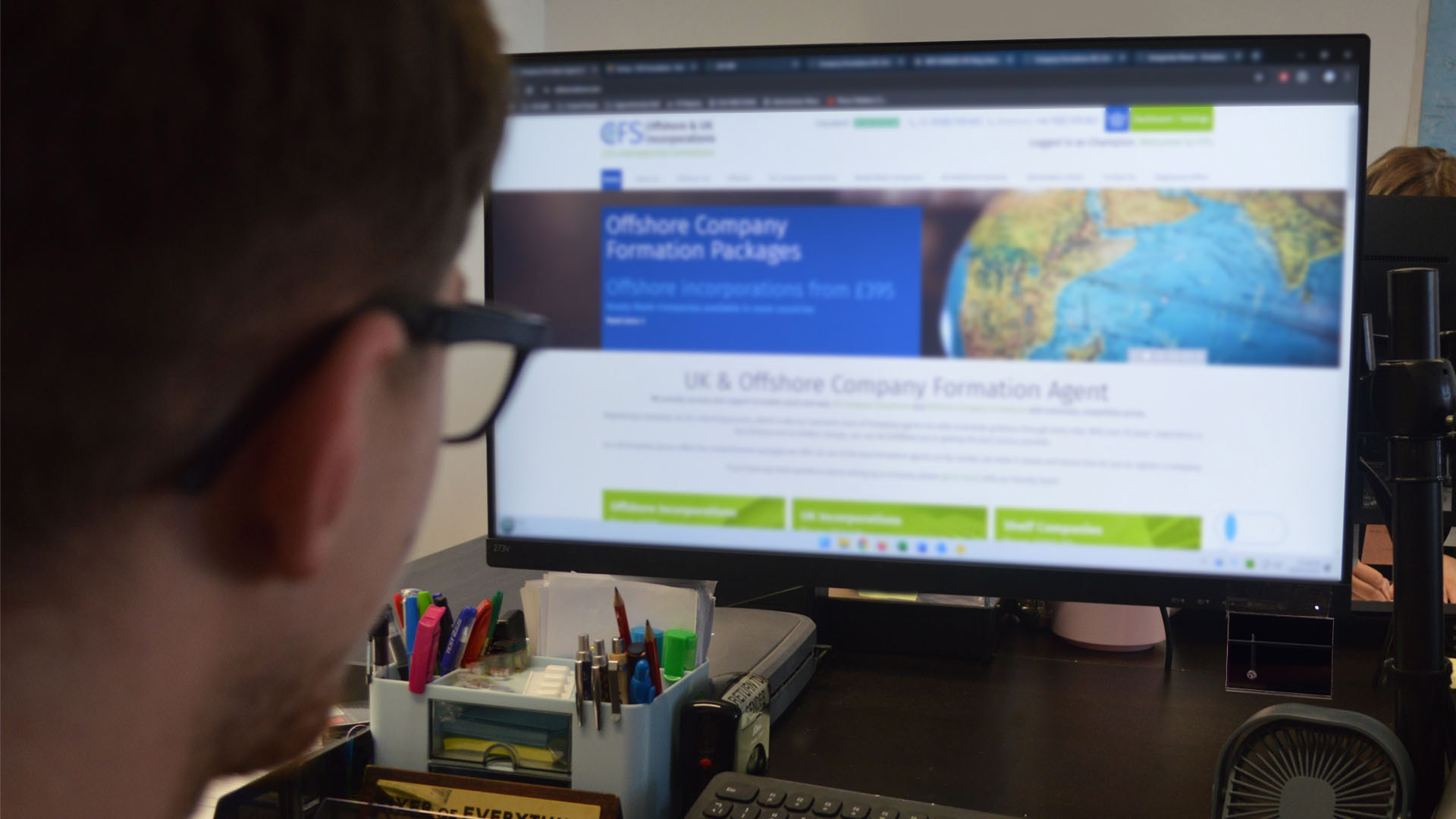

Setting up your offshore company may seem like a daunting process, which is why at CFS Formations we want to ensure the process is straightforward for you.

There are so many locations, each with their own benefits and advantages to suit you and your business needs. It is crucial to invest time into researching the best Jurisdiction that will benefit you.

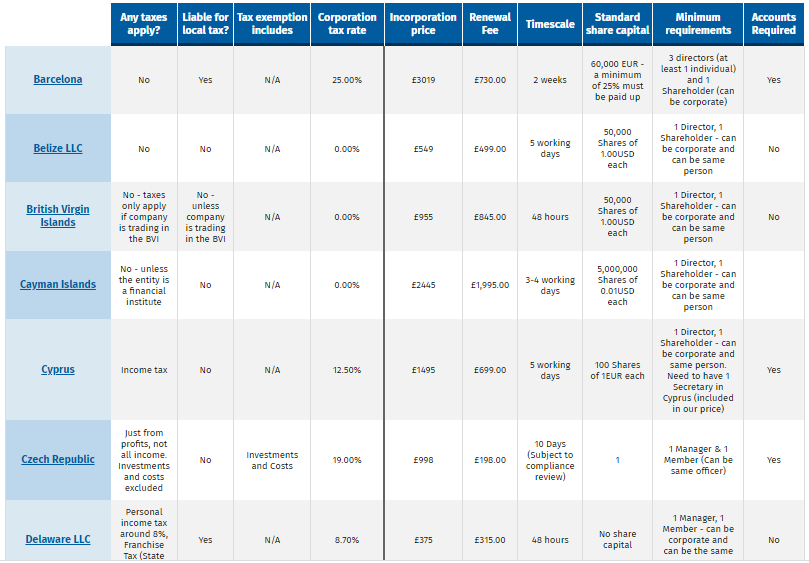

Our comparison page is helpful when choosing an offshore jurisdiction and displaying taxation on each jurisdiction. As a Formation Agent, we are unable to give business or Tax Advice however, the comparison table does provide information you may need to make your decision. This page allows you to view the different local taxes, corporation tax rate and more.

You can view our comparison table by clicking here.

Please feel free to contact us via WhatsApp on +44 (0) 7874602235

One of our team will respond to you within our office hours of 9AM-5PM GMT.

We will be closed on Tuesday 24th December 2024 from 12:00pm GMT.

We will reopen Thursday 02nd January 2025 at 9.00am GMT.

All electronic incorporations and filings can still be submitted and will be processed as usual.

All orders can be submitted as usual and they will be processed as quickly as possible on our return.

Our offices will be closed for telephone and email support during this time. Please still contact us via email and we will respond to you when we return to the office.

Please feel free to leave us a voicemail and we will call you back on our return.

We would like to take this opportunity to wish you a Merry Christmas and a Happy New Year!

CIC companies can be formed Limited by Shares or Limited by Guarantee, both formation types are legal entities and there are fundamental differences between them both.

Limited by Guarantee companies are generally not-for-profit organisations, whereas Limited by Shares companies are used to generate a profit.

We can assist with both a CIC Limited by Shares and a CIC Limited by Guarantee.

More information can be seen on the following link: https://www.cfsformations.com/packages/community-interest-company

We are always looking for new ways to improve our website and we are pleased to announce our new About Us page is now live.

We hope this will provide our clients with a better insight to who we are and the services we have available.

Please click here to view our new About Us page: https://www.cfsformations.com/about-cfs

Companies House are now back up to date with applications, this includes incorporations and any filings. The average time frame is ranging from 1 – 17 working hours.

Please be assured we will continue to monitor all applications and provide you with updates if any back log occurs. If you have any questions regarding the registry’s processing times, please feel free to contact our friendly UK Specialists.

Earlier this year, the UK Registrar made significant increases to their internal prices.

Due to this, CFS Formations are unfortunately no longer able to offer the free Change of Company Name service with our UK Shelf Companies.

We are instead now offering a discounted price if you select the option of changing the name of your chosen Shelf Company.

If you have any questions regarding this change, please contact one of our UK Specialists:

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Tel: +44 (0)1302 729041

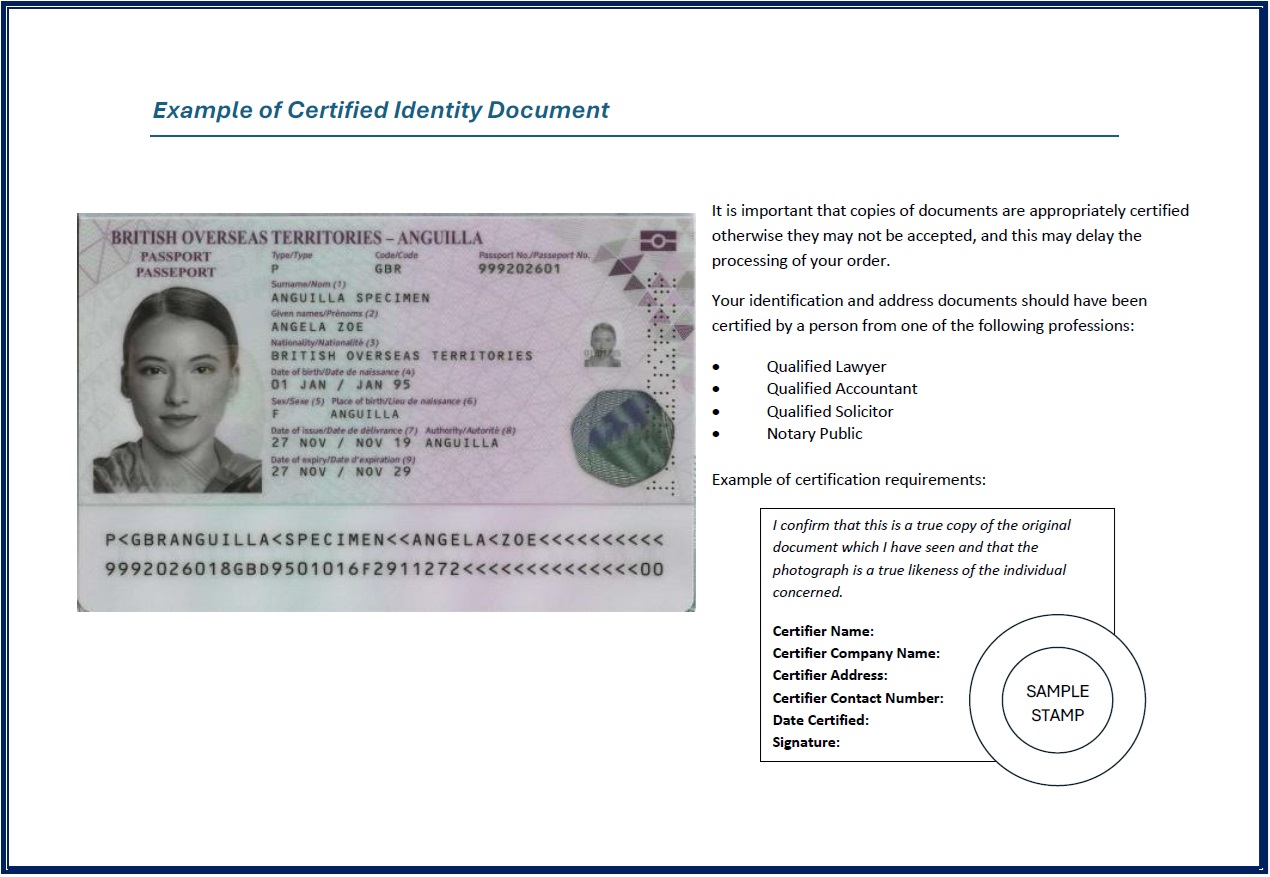

We have recently introduced a new procedure for verifying the identity of individuals placing orders on our website.

As we are regulated by HMRC under Money Laundering Regulations 2017 and KYC (Know your Customer) Guidelines, we are legally required to perform identity and address checks on our customers.

CFS Formations are now in partnership with a secure, third-party company known as SumSub, which allows us to digitally verify individuals identity in just minutes!

Compared to our previous procedures, we have seen great improvement to the time taken to verify individuals identity.

Currently, we are only using SumSub's verification for UK Shelf Company orders, however we expect to expand onto other services in the future.

We will make you aware when these changes are coming into effect.

Please read our Help and Guidance article below to learn more about SumSub:

https://www.cfsformations.com/help-guidance/id-verification

Please feel free to contact us via WhatsApp on +44 (0) 7874602235

One of our team will respond to you within our office hours of 9AM-5PM BST.

We are pleased to add a new location to our Offshore Formations.

The St Kitts & Nevis is becoming a popular location due to their stable and political economic environment.

Our comprehensive package includes all the requirements to form a company in the St Kitts & Nevis.

The company requires a minimum of one Director and one Shareholder, which can be the same person.

Another great advantage is that companies trading outside of St Kitts & Nevis are considered non-resident for tax purposes and are therefore, not subject to corporate income tax in Nevis.

You can read more on our package here.

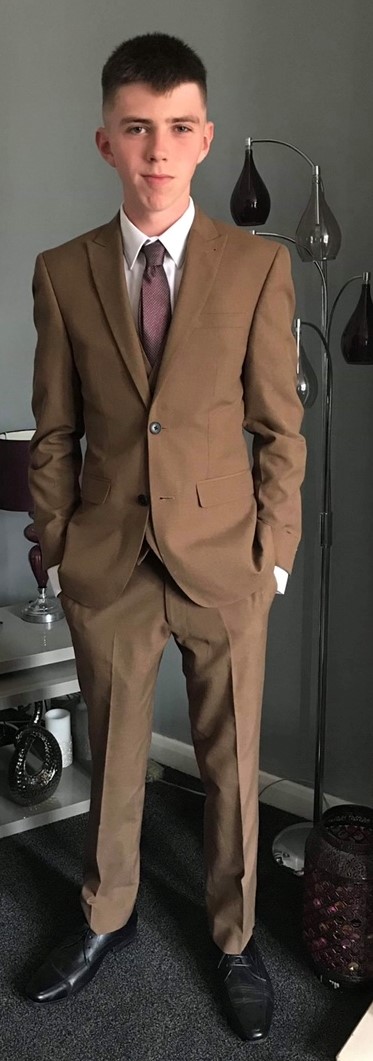

We are pleased to congratulate our IT Specialist, Leon on his third year with CFS International Formations.

Leon commented:

"Is has been a great three years working at CFS. I enjoy working in a busy environment where every day is different.

CFS have given me so many great opportunities and I look forward to developing my knowledge and skills in the coming years."

Congratulations to Leon for his hard work and dedication over the last three years!

We are proud to partner with a recent award-winning bank. Our Belize International Bank have been presented with the following five prestigious awards:

Best Offshore Bank for CARICOM 2021 as awarded by International Investor Magazine, the Best Private Bank in Central America for 2021 as awarded by Global Banking & Finance Review, and most recently, the Annual Global Economics Awards awarded Belize International Bank 'Best Offshore Bank 2024'.

President Luigi Wewege expressed how happy he is with this award. “This award for Best Offshore Bank in CARICOM 2024 is a tremendous honour for our entire team”.

CFS Formations is a Registered Office Address provider. We have a variety of addresses available, with the Registered Office service, you can decide whether you wish to receive all post or General Business Correspondence. You can use the address as a registered address in the UK for the company from HMRC and the company registrar. There is also the option to have your post scanned or sent in original form.

Many of our clients prefer to proceed with our scanning option as this is a same day scanning service. Once mail is received to our office, this is scanned on the same day whereas the postage option is sent weekly. This is a free service and doesn’t come at an extra cost to have this scanned on the same day.

Registering a company in the UK is a straightforward process. However, sometimes applications are rejected by the UK Registrar (if you are forming through our website, there is no charge to resubmit a company for incorporation). Here are some common reasons why your company may be rejected:

Company Name:

There are certain rules and requirements concerned when registering a company name:

- Sensitive Words – If your company name contains what the registry consider ‘sensitive words’ (for example Bank, Court, Institute) you must supply a supporting document confirming you have permission to use the word. The name also cannot suggest any connection to His Majesty’s Government or local authorities. We have a page detailing all of the registry’s requirements for specific sensitive words – please see here.

- Offensive – The registrar will not accept a company name should it include any rude or offensive words in any shape or form.

- Similar Names – The proposed company name cannot be the same or too like one that is already on the UK Register. You can check the availability of a company name before you begin your incorporation application.

Residential Address:

Another common rejection we often see is where an officer’s proposed Residential Address is a business premise. The UK Registrar will not accept an officer’s residential address if they believe it is a business premise or believe the officer does not reside there. In certain cases, there may be a mismatch on the address where we can appeal the registry’s decision by providing them with a proof-of-address document confirming the officer does in fact reside there.

S243 Exemption:

The S243 Exemption discloses the Director’s information from being shared due to their nature of business. This is in place to protect the safety of the company officer (and those they live with). Within our online order form is a ‘Confidentiality Address’ option, which is sometimes mistakenly selected. If the officer does not have permission to have their information disclosed, then the company will be returned rejected if this option is selected. If you do not have permission from the UK Registrar to tick this box, we please ask that you refrain from selecting it.

If you have any questions regarding UK Company Rejections, please do not hesitate to contact one of our UK Specialists who are experienced with all areas of company rejections.

We will be closed on Monday 26th August for August Summer Bank Holiday.

We will reopen the following day on Tuesday 27th August at 9.00am BST.

All electronic incorporations and filings can still be submitted and will be processed as usual.

All orders can be submitted as usual and they will be processed as quickly as possible on our return.

Our offices will be closed for telephone and email support on these days. Please still contact us via email and we will respond to you when we return to the office.

Please feel free to leave us a voicemail and we will call you back on our return.

Don’t forget to take advantage of our Shelf Company Summer Promotion.

We are pleased to announce we are reducing the price of our 2020 UK Shelf Companies from 795.00 GBP to only 695.00 GBP

The discounted price will only be available until the 31st August 2024.

Here are a few reasons why people choose a Shelf Company:

• Boost your business with an established company

• Establish business relationships easily

• Gain confidence from customers

• Simplicity – the process is simple and straight forward

Transferring a Shelf Company using CFS formations ensures a simple and straight forward process, we are able to transfer the company usually within 24-48 hours.

Follow the link below to view our list of available UK Shelf Companies: https://www.cfsformations.com/uk-shelf-companies

4 Reasons to choose CFS:

Here are four reasons you should choose CFS Formations to incorporate your company, whether it be in the UK or Offshore:

Fast Processing Times:

We file electronically with the UK Registrar, meaning your company is processed for incorporation as soon as you make payment, even outside of our office hours! This means we can offer the quickest formation turnaround time on the market. As for Offshore Incorporations, we pride ourselves on working with the most efficient overseas agents, again meaning we can offer some of the quickest turnaround times in all the jurisdictions we work with.

Quality Customer Service:

By using CFS Formations, you can be assured that our friendly UK and Offshore team have the skills to provide a fast, efficient and reliable process for incorporating and maintaining all aspects of your companies. We can offer customer service via telephone, email, live chat and WhatsApp.

Variety of services and jurisdictions offered:

Not only do we offer Company Incorporations both in the UK as well as 22+ overseas jurisdictions, but we are also able to offer a wide range of additional services for all your business needs. Some of our popular additional services are company filings, address services and company dissolutions & restorations.

Honest, upfront prices with no hidden charges:

Our ambition is to offer the most honest, fair prices for registering and managing your company. All prices listed on our website include the total costs for the service you are ordering. We offer additional services for most company formations which will incur additional costs, you will be made aware of these should you select to take advantage of them.

We have a number of locations available for Crypto Trading Companies, please see below list of acceptable jurisdictions:

- Panama

- Czech Republic

- Delaware

- ST Vincent

- BVI (dependant on the activity)

- Seychelles (Additional Compliance fee can apply)

Find out more about our popular locations by clicking here

The UK Registrar introduced a large set of changes to the way they process company incorporations at the start of this year. These changes caused a strain on the timeframes for company incorporations and filings, specifically paper based. During the past couple of months, the timeframe has slowly began improving back to the usual 24–48-hour timescale and as of this month it looks to be fully back to normal.

You may still find there is a slight delay with incorporations processed on Fridays or over the weekend, this is because the registry rarely processes over the weekend.

When using CFS Formations for your company incorporations and filings, you can have the peace of mind of knowing we actively chase the registry for any filings or incorporations that exceed their standard timeframes.

If you have any questions regarding the registry’s processing times, please feel free to contact our friendly UK Specialists.

CFS Formations are proud to be rated as excellent on the most trusted review platform in the world, Trustpilot. We strive to take all reviews, good or bad, into consideration to provide better experiences to our clients. You are able to view all of our reviews here.

We have recently exceeded 700 reviews, over 90% of which are 5 stars. Look at what one of our happy customers thought of our services if you can’t take our word for it.

CFS Formations are able to assist with amending your company articles after the company has been incorporated.

Most people choose to use the Model Articles of Association, however, some people have special requirements which must be set out in the Articles of Association. Therefore they would either create their own Articles to submit with their new company or they would change the Articles once the company has been incorporated.

What do I need to change my Articles?

To change your Articles of Association for an existing company, you will be required to provide us with the following:

- New Articles of Association

- Special Resolution to change the Articles. We will provide you with the Special Resolution, which will need signing by the Director of the company

How long does it take to change the Articles?

It usually takes around 5 working days for Companies House to update the company records with the new Articles of Association. We will send you email confirmation once the new Articles have been accepted with Companies House.

You are able to order this service from our UK Additional Services page, please do not hesitate to contact one our UK Formation Specialists if you have any questions regarding changing your company articles.

We can assist in applying to a variety of offshore banks. We are currently partnered with 11 offshore banks to ensure we can provide a range of options to benefit each individual company’s needs.

We are also able to open personal accounts with some of our banking partners.

More information on the banks, including their fees and requirements can found on the following link: https://www.cfsformations.com/offshore-formations/bank-accounts

Delaware LLC’s and Marshall Islands Companies are our quickest jurisdictions we offer.

Both of these jurisdictions are really popular due to their fast formation, minimal filings and privacy.

We will require the following due diligence documents:

- Certified Passport for all officers dated in the last 3 months

- Certified Proof of Address for all officers dated in the last 3 months

Once we have the required due diligence documents, the company is formed in around 24 hours.

A Registered Office is an official address of an incorporated company and it is a legal requirement to have a registered address within the UK for your company. CFS Formations is a Registered Office Address provider, and we have a variety of addresses available, with the Registered Office service you will be able to decide whether you wish to receive all post or General Business Correspondence as well as being able to use the address as a registered address in the UK for the company from HMRC and the company registrar. There is also the option to have your post scanned or sent in original form.

A Correspondence Address is an official address that all company directors are legally required to have when they are appointed to a UK Company. This address does not have to be located in the UK but, is an address you can be officially contacted at. This address is displayed on public records, however the Correspondence Address service allows directors to use CFS Formations address to hide their private addresses. Kindly note that our Correspondence Address services can only be used if the company is also using our Registered Office Address service.

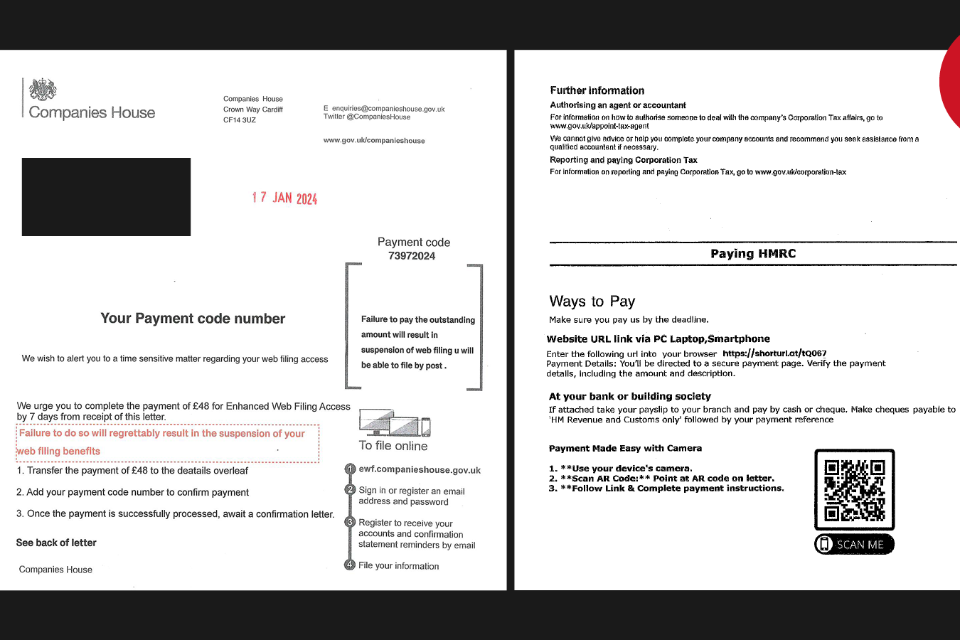

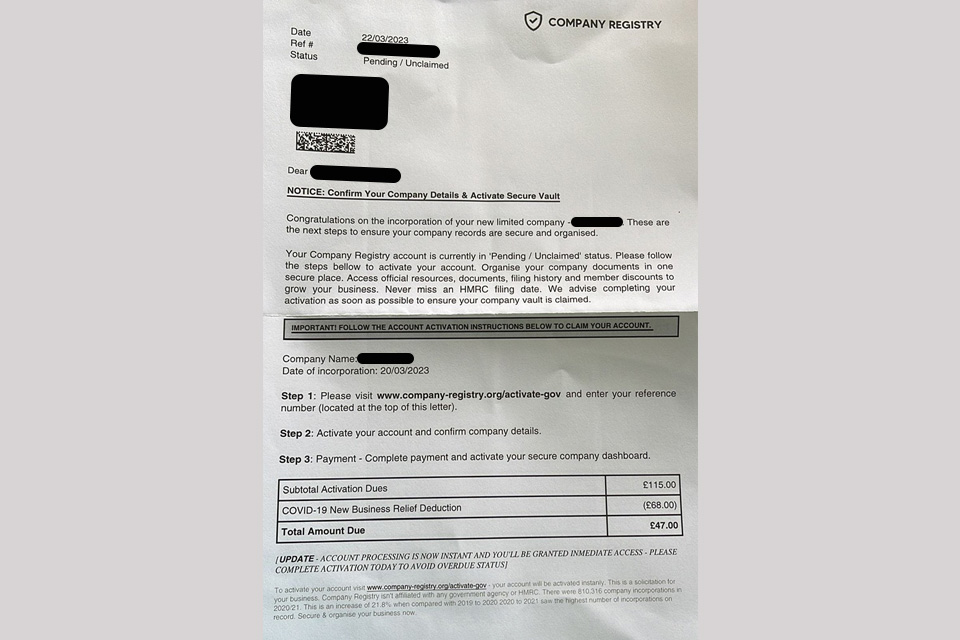

Please be aware that scam letters are currently circulating which present to be from Companies House.

The scam letters claim that you need to make payment for an ‘enhanced’ web filing access.

Please do not follow any instructions from the letter, do not scan any QR code and never transfer any money.

If you receive a suspicious letter claiming to be from Companies House please contact us immediately and dispose of the received correspondence.

More and more instances of this are occurring so we advise clients to be vigilant with any correspondence received. Any letters receved by Companies House/HMRC will (in most cases) have their branding on the envelope.

Please see examples of the most recent scam letters we have received to our office. If you are using our Registered Office service you can have the peace of mind that these scam letters will be disposed of before you receive them.

With all our UK company formations, we are pleased to inform you we offer a free bank account referral for all UK residents.

For new and existing companies, we are able to refer you to one of our business banking partners which can help you set up your business bank account.

The advantages of having a business bank account for your limited company is imperative. The bank account allows you to keep your business finances separate and will be necessary for any accountancy services you use.

Please do not hesitate to contact us if you wish to proceed with the referral, we will be more than happy to assist you.

If you would like to incorporate a company with different share classes, this would usually need to be processed by paper. However, we can assist with quickly incorporating your company with different share classes electronically.

If your company has shares which have different rights, for example voting rights, you will be required to add different share classes to the company. Most companies have only one class of shares, which is ‘ordinary’ shares, they carry one vote per share, are entitled to participate equally in dividends and, if the company is wound up, share in the proceeds of the company's assets after all the debts have been paid.

It is becoming quite common for companies to have different share classes. Any company can create different classes of shares by setting out those classes and the rights attached to them within the company’s articles. This may be done for various reasons, such as to be able to vary the dividends paid to different shareholders and to create non-voting shares.

The most common type of share classes which are used are:

- Ordinary Shares

- Preference Shares

- Non-Voting Shares

- Class A (Alphabet Shares)

- Class B (Alphabet Shares)

You are able to add different share classes to existing companies, or you can set up your own company with different share classes. Different share classes should be used when the shares have different rights, such as voting shares.

We work closely with our banking partners to ensure we provide you with the best available corporate accounts, fee structure and confidential service with the most up to date and accurate information available.

There are many reasons why offshore banking could be beneficial to your business. Security and privacy are especially important so you can feel secure knowing that your money is safe and protected.

Please see below key factors of why Offshore Banking may be suitable for you:

- Privacy/Security

- Convenience

- Level of Service

- Competitive Exchange rates

- International Experts

Please find more information as follows: https://www.cfsformations.com/help-article/benefits-of-offshore-banking

A registered office is the official address of a UK company. It is a legal requirement to have a registered address for your business and the address must be within the UK.

The registered office address is important as it is where any legal or official mail is sent to by the Government, Companies House and HMRC.

You will have the option to either have your mail scanned daily or posted to you weekly with our registered office service.

When purchasing one of our Registered Office Addresses, you will have the option to choose either General Business Correspondence or all post. All post is all mail we receive will be passed onto you and General Business Correspondence is post receive only from HRMC, Companies House or ICO will be passed onto you.

If you are interested in using one of our Registered Office Address, please see more information here:

https://www.cfsformations.com/registered-office-address

This is a question that a lot of clients ask us, whether a ready-made company is best for them and what are the advantages.

Obviously, you are the only one that can decide what option is best for you. It’s good to do some research on what options are available.

We hope the advantages displayed below will give you an idea on how you wish to proceed and help assist you make the right choice.

At CFS, we have a range of ready-made UK companies available to purchase, with incorporation dates ranging from 2014-2024.

A great benefit of a Shelf Company is they enable your business to appear more trustworthy, your suppliers and clients are likely to have more confidence in businesses that have a longer operating history.

Here are a few reasons why people choose a Shelf Company:

- Boost your business with an established company

- Establish business relationships easily

- Gain confidence from customers

- Simplicity – the process is simple and straight forward.

When proceeding with a UK incorporation you have the option to upload your Articles of Association.

This option is free of charge and simple to use on our website. You will be able to select the upload link to attached the articles in PDF format.

Kindly note, when selecting the option to upload your own company articles these will be displayed on public records with Companies House. A Memorandum of Association is not required to be uploaded as this automatically generated by Companies House.

Please see below a link to our website displaying more information: https://www.cfsformations.com/changing-articles-of-association

A Registered Office is an official address of an incorporated company and it is a legal requirement to have a registered address within the UK for your company. CFS Formations is a Registered Office Address provider and we have a variety of addresses available, including services whereby you only receive official government letters and a service where you can receive all letters for your company.

A Correspondence Address is an official address that all company directors are legally required to have when they are appointed to a UK Company. This address does not have to be located in the UK but, is an address you can be officially contacted at. This address is displayed on the public records. Kindly note that our Correspondence Address services can only be used if the company is also using our Registered Office Address service.

We offer a variety of packages when incorporating a UK company.

We have created a Help and Guidance Page to assist you with choosing the right package.

Our packages are tailored to suit your exact requirements. Prices start from 27.95 GBP, for our most popular E-Mail Package.

This Package includes a wide range of services: Free Bank account referrals, 3 Months Free Accountancy, Emailed Official Company Documents and much more.

https://www.cfsformations.com/help-article/uk-incorporations-and-types

The page provides you with benefits and a breakdown of each package.

Our Belize International Bank Account is fast becoming one of our most popular choices for clients with international banking requirements.

The Bank accept companies incorporated in most locations whether you have a registered IBC or LLC, they can cater for your requirements.

Caye operates similarly to a digital online bank, which means that they are able to eliminate the costs typically associated with traditional retail banks, thus enabling them to offer great tailored services to bank customers.

They offer a full range of traditional and none traditional banking services with a range of currencies available. The account opening is simple and there are many advantages, you can find out more here.

We can offer Shelf Companies overseas as well as in England!

A great benefit of a Shelf Company is they enable your business to appear more trustworthy, your suppliers and clients are likely to have more confidence in businesses that have a longer operating history.

We can offer a Shelf Company in the following jurisdictions:

- Ireland

- Seychelles

- Sweden

- St Vincent

- British Virgin Islands

- Marshall Islands

- England/Wales

You can view more information by clicking here.

An apostille is an internationally recognised certification used to authenticate public documents. It is issued on documents daily across the globe.

We offer multiple apostille services, please contact our office to discuss your specific requirements and one of our friendly team will be happy to help.

The telephone redirection service is a service that is usually provided to overseas customers but can be provided to UK customers too. This service provides you with a UK Number that can be used for your company, all calls that are made to the UK Number will be redirected to a contact number of your choice.

The telephone service is valid for a period of 6 months and can be renewed after this period. We will send you an email notification 1 month before the service is due for renewal.

The following is included in the telephone redirection service:

- Set up fees.

- 6-month line rental

- Call deposit

The calls can be redirected to a telephone number of your choice. Call redirections are free to UK Landlines, however to overseas destinations and mobile networks, additional charges will apply.

You can view more information on our Telephone Redirection service through our Additional Services page.

We would like to make our clients aware of a new fraud scam that is circulating with new companies registered within the UK. All newly registered companies in the UK receive a letter from HMRC containing their UTR (Unique Tax Reference) Number, these letters contain only your UTR Number and information regarding the use of the UTR.

The new scam that is circulating sees new companies receiving a very similar copy of the standard HMRC UTR letter, however the letter requests that the newly incorporated company must pay a fee to gain access to Web Filing Services. On the back of the letter is a ‘Way to Pay’ section taking you to a website that is not involved with HMRC.

If you receive this type of correspondence CFS Formations urge you to dispose of the letter and take no further action, the UTR Number on this letter is not the same as your official UTR Number that is sent from HMRC.

Please do not hesitate to contact us should you have any concerns regarding correspondence received from HMRC / Companies House.

Voluntary Striking Off is a procedure to remove a company from the register when a director decides they no longer require the company. To apply to Strike Off a company the Director is required to sign a form confirming they agree to the company being struck off.

Once the original form is received by Company Registrar, it takes around 5 days for the application to be accepted, and then a further 3-4 months for the company to be completely struck off from the register. CFS Formations are able to assist in applying to Strike Off your company and this can be ordered through our Additional Services page for GBP 50.00.

If you have any questions regarding the Voluntary Striking Off service, please Contact Us and one of our Administration team will be happy to assist.

Nevada is one of the most popular states in the USA and has an exciting business community.

It is a great choice for clients wanting to start or expand their business for a wide range of reasons.

If you are looking at the tax prospects, there is no tax on corporate or income shares. No personal tax, annual franchise tax, inheritance tax or inventory tax.

It also boasts some of the lowest sales and property tax rates in the country.

Nevada has some of the most business-friendly laws and allows none residents to be owners of the company.

By using CFS formations we ensure that the company is set up legally and with all the requirements that are needed to begin trading. Please note that a business license is required in Nevada and unlike other formation agents we include this in our package.

Shareholders and business owners are also not required to submit their list of assets to the state.

Find out more about how CFS Formations can form your Nevada company by following the link:

https://www.cfsformations.com/offshore-formations/nevada-company-registration

A Registered Office is an official address of an incorporated company and is publicly available. It is a legal requirement to have a registered address for your business and the address must be within the UK. CFS Formations is a Registered Office Address provider.

Our Registered Office Address service is valid for a period of 12 months and will show on public record and with UK HMRC.

The Registered Office Address must be kept up-to-date, and it is necessary that the service is renewed on time every year if you are using our Registered Office Address. If the service is not renewed, the Company will no longer receive any statutory correspondence, and it could affect the company’s status of good standing.

After the service has expired, we will allow a one-month grace period to renew the Registered Office service with us before we inform Companies House the company no longer has authorisation to use the address and a late renewal penalty will apply when the service is later renewed.

As a CIC company is a relatively new type of company, existing companies prior to 2005 will not have had the opportunity to be incorporated as a CIC Company.

If your business is benefitting the community but is already existing as another company type, you may wish to convert your company to a CIC Company.

You can view more information by clicking here.

We are extremely honoured to have won the award for Company Formation Agency of the Year 2023.

For over 20 years, we’ve excelled in providing a first-class service for clients worldwide and feel privileged to have been acknowledged with this award.

Here at CFS Formations, we have the skills and experience to ensure that your company is set up correctly in either the UK or offshore.

We are committed to maintaining the highest possible standards for our customers and are more than willing to go the extra mile to ensure complete customer satisfaction.

A Registered Office is an official address of an incorporated company and it is a legal requirement to have a registered address within the UK for your company. CFS Formations is a Registered Office Address provider and we have a variety of addresses available.

A Correspondence Address is an official address that all company directors are legally required to have when they are appointed to a UK Company. This address does not have to be located in the UK but, is an address you can be officially contacted at. This address is displayed on the public records.

Kindly note, our Correspondence Address services can only be used in conjunction with our Registered Office Address service.

We can assist with registering UK Companies for VAT. By registering your UK Company for VAT, you will receive a company VAT Number.

If your taxable supplies exceed the VAT Registration threshold of 83,000GBP (1st April 2016) then you are legally obliged to register for VAT. Taxable supplies are anything that is subject to VAT. Therefore, if your turnover of taxable supplies exceeds 83,000GBP or if you think that it will, then you must register for VAT.

Due to the popular demand of our VAT Registered Shelf Companies, we provide VAT Registration as an additional service for UK Companies.

Please click here to view more information about our VAT Registration service.

Want to establish your company offshore but unsure where?

We have a free comparable page highlighting the requirements, prices and taxes for each jurisdiction. This should help you to make an informed choice on where best to form your company.

You can view more information from the following link: https://www.cfsformations.com/offshore-formations-tax-details

We offer a Nominee Director service to help clients keep their personal information off the public record while ensuring full legality.

We offer a Nominee Director service for UK and Offshore Formations. With a nominee service, you can protect your details and ensure confidentiality. Please note, all our Nominees appear in name-only and will have no involvements in the company. If you would like further information on our nominee services, our UK team will be happy to assist!

More information and prices can be located here under UK Additional Services.

If a company has been dissolved by Companies House and you would like your company to become active again it will need to be restored back to the Register of Companies.

If the company has been dissolved by Companies House via compulsory striking off, we can apply for it to be Administratively Restored back to the Register of Companies.

If the company was dissolved via voluntary striking off following the Directors instruction, we can apply for a Court order to allow your company to be restored back to the Register.

Our Restoration Service includes the preparation and filing of the relevant forms with Companies House and also the Treasury fees. If there are any outstanding filings or penalties we can advise of these additional costs and deal with any issues on your behalf.

If you require assistance with restoring your company back to register, please do not hesitate to contact us we are happy to help.

Welcome our newest employee, Scarlett!

Scarlett joined the team in May 2023 as a UK Business Administrator.

Whilst currently completing her qualifications in Business Administration Scarlett will be focusing on UK orders and working within our UK Business team.

We asked Scarlett:

What is your favourite part about working for CFS Formations?

I love coming into work and learning new things everyday and having new experiences with customers. CFS has a very positive / comfortable environment and has been a great experience so far!

We also asked Scarlett what she likes doing in her spare time?

In my spare time I like to hang out with my friends or watch movies with my family. I also like to listen to music and online shop!

UK Incorporations and Filings by paper have become increasingly popular causing an increased workload at the Registrar. This is causing a strain on the Registrar which is having a ripple effect on the average incorporation time (24-48 hours) and processing times for paper documents.

Companies House have a guide available to view the current paper documents processing times, this can be viewed here.

Please be assured we are actively chasing any Incorporations or Company Filings with Companies House that are exceeding the standard processing times.

As part of the new BVI Business Companies Act all companies are now required to file an Annual Financial Return which contains specific financial information.

From 2024 all BVI Companies that are not registered with the FSC will be required to file Annual Financial Returns.

We will provide you with a draft copy of a simple balance to complete with the company financial information. The information is not made public and is held only with the licensed agent in the BVI.

The filing of the Annual Financial Return is included in our yearly renewal price.

To read more about the BVI, please click here.

After noticing slight delays with incorporations and company changes with Companies House, we have been in discussion with our Account Manager who has advised us that there are several factors affecting the processing times.

UK Incorporations and Filings have become increasingly popular causing an increased workload at the Registrar. This is causing a strain on the Registrar which is having a ripple effect on the average incorporation time (24-48 hours).

Due to the upcoming legalisation coming into force with Companies House, their staff are undertaking vigorous training and role changes to ensure a smooth transition. With staff taking on their new roles, previous roles that monitored UK Incorporations and Filings are limited, causing more pressure on their already increased workload.

Once training has been completed, they expect their turn around times to improve and return to normal.

Please be assured we are actively chasing any Incorporations or Company Filings with Companies House that are exceeding the standard processing times.

We are a team of company formation agents, specialising in all aspects of company start ups both in the UK and overseas, we can assist in company formation in over 20 different jurisdictions.

All of our packages include everything that you need to start your new company, including fully completed company documents with all your officer information.

If you require a specific service that is not included in any of our packages, please let us know as we can tailor our packages to suit your individual requirements.

Please click here to view all of our Jurisdictions: https://www.cfsformations.com/offshore-formations

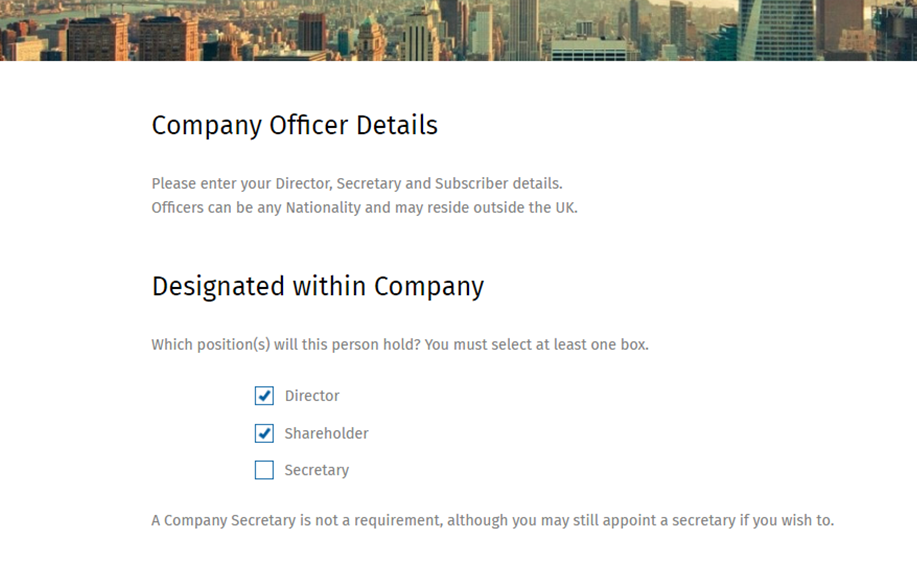

A minimum of 1 Director and 1 Subscriber/Shareholder is required for a UK company formation and this can be the same individual who acts in both positions. This is achieved by selecting both Director and Shareholder when inputting the designated positions of the officer.

Please do not try and appoint the same person twice as this will not allow you to proceed. You must select how many positions they are acting in at this stage.

We can incorporate a Scotland Registered Limited Partnership. A great benefit is the Limited Partnership’s income is not taxed at the business level. Instead, business profit and loss are passed through to the partners for reporting on their personal tax returns.

This type of partnership requires 2 or more people, at least 1 person to act as the General Partner who has management authority and personal liability, and at least 1 person to act as the Limited Partner who is an investor and has no management authority.

To view more information on our Limited Partnership formations, please click here:

Offshore companies can provide an additional layer of privacy protection by information not been held on a public registry.

We offer numerous jurisdictions which currently have a private registry, such as:

If you would like to create a Non-Trading, Dormant Company or wish to Reserve or Protect a Company or Business Name, then our Reserve a Company / Business Name Package is just for you.

Our Reserve a Company name service registers the name of your company at Companies House preventing anyone else from using or trading with that name.

You cannot trade with a reserve a name company, it is created just to protect the company name for you and to prevent another person from trading with your chosen company name. We will incorporate the company with your chosen company name, using our Registered Office and with CFS acting as Director, Secretary and Shareholder of the Company.

If you wish to trade with the company, at any time, we can transfer ownership over to you, just let us know.

There is an administrative charge for us to transfer the ownership over to you.

To view more information on our reserve a company name package, please click here.

https://cfsformations.com/help-article/reserve-a-company-name-protect-a-company-name

We will be closed on Monday 08th May 2023 for the Coronation of King Charles III.

We will reopen Tuesday 09th May 2023 9.00am BST.

All electronic incorporations and filings can still be submitted and will be processed as usual.

All orders can be submitted as usual and they will be processed as quickly as possible on our return.

Our offices will be closed for telephone and email support on these days. Please still contact us via email and we will respond to you when we return to the office.

Please feel free to leave us a voicemail and we will call you back on our return.

All companies registered in Gibraltar are required to file Accounts on a yearly basis.

It is now a requirement that our Gibraltar office hold or have access to full accounting records.

The accounting records includes but is not limited to the following:

- Bank Statements

- Receipts

- Invoices

- Vouchers

- Title Documents

- Contracts and Agreements

- Ledgers

- Any other documentation underpinning a transaction

We offer several options to our clients which allows flexibility and allows for differing circumstances.

The 3 accounting options we are offering, are as follows:

- Trading / Operating Company - Referral to Gibraltar Accountant

For Companies who require full bookkeeping and accounting service.

We will refer you onto an Accountant in Gibraltar and they will assist you with all the accounting requirements, including the filing of your accounts.

- Dormant / Holding Company Only

For Companies who intend to carry out their own Bookkeeping, Accounts preparation or have an existing Chartered Accountant for their company.

- Trading / Operating Company with your own Accountant

This will be beneficial for companies that have their own qualified Chartered Accountant and use an acceptable cloud based bookkeeping package (such as Sage, Xero or Quickbooks).

You are able to view information regarding our Gibraltar Formation package by clicking here.

We offer a number of different nominee services helping clients to keep their personal information off the public record while ensuring full legality.

We offer Nominee Director, Nominee Shareholder and Nominee Secretary services for UK and Offshore Formations. With a nominee service, you can protect your details and ensure confidentiality. Please note, all our Nominees appear in name-only and will have no involvements in the company. If you would like further information on our nominee services, our UK team will be happy to assist!

More information and prices can be located here under UK Additional Services.

When you are ready to purchase services from CFS, you will firstly need to register as a user on our website. You can do this quickly and easily by clicking the Sign In / Register button on the top right hand side. You can create your own username and password.

By creating a username, you will be able to see all past and present orders, request your own invoices, keep track of your companies and much more.

We also offer the option to register as an agent, this is for making multiple orders, acting or intend to act on behalf of a client i.e., if you are an Accountant or Formation Agent, Solicitor or another Professional Company.

An Apostille is a form of authentication issued to documents for use in countries outside of the UK.

We are able to offer a standard and expedite service on this additional service.

The Notarisation of Documents confirms that the documents included in the Apostille are a true copy of the originals.

The Notary will apply a seal and sign the documents whilst, The Foreign and Commonwealth Office will then attach an apostille to the documents. This confirms the Notary’s signature and seal has been certified.

Once a document has gained an apostille certificate these documents are then legal for use and can then be presented to any country which recognises the Apostille without requiring further legalisation.

We are extremely privileged to have won the award for Most Client-Focused Formation Agent 2023.

For over 20 years, we’ve excelled in providing a first-class service for clients worldwide and feel grateful to have acknowledge with this award.

Here at CFS Formations, we are committed to maintaining the highest possible standards for our customers and are more than willing to go the extra mile to ensure complete customer satisfaction.

We have the skills and experience to ensure that your company is set up correctly in either the UK or offshore and always ensure that our customers are satisfied with the services we provide.

This type of company is easy to set up with flexibility and has some special features to ensure they are working for the benefit of the community.

- CICs are useful for enterprises of all sizes from a small community care project to a large organisation

- A CIC registration is intended to use their income and profits to benefit the community they are serving

- A Community Interest Company (CIC) is a Limited Company with special additional features

On average it takes around 5 working days to complete a CIC registration once we have received all signed documents.

You can view more information by clicking here.

Our online chat facility is available to answer any quick questions and provide guidance where required.

Unlike other companies, you will physically speak to a person and will not be directed to an automatic robot. You will be connected to our admin team who specialises in all aspects of company start-ups both in the UK and overseas. They will be able to deal with your enquiry quickly meaning you should receive a response to your questions/queries instantly.

The chat is available in the bottom right-hand corner of our website, to begin a conversation simply select the chat support button and you will be connected to an available operator.

Our chat facility is available Monday – Friday 9AM-5PM GMT.

We are pleased to announce we are now offering Private Fund Limited Partnership Formations for UK companies.

A Private Fund Limited Partnership Formation is a type of partnership which is registered with the Limited Partnership Act 1907. Private Fund Limited Partnerships benefit from a right to appoint a person to wind up the partnership if the general partner is unable to do so. A PFLP benefits from a "white list" of authorised actions which limited partners in the PFLP can take without being considered as participating in the management of the limited partnership and so losing their limited liability.

The Standard Industrial Classification System, or SIC, is a numerical scheme used to classify businesses according to industry type. Companies in the same industry were assigned the same number or SIC code.

The SIC Code is basically a short description of the company business activities. This will be determined by a standard list of codes that are provided by Companies House.

You are able to chance the SIC Code of a company by filing a confirmation statement. The price for us to file a confirmation statement and change the SIC Code is: 28.00GBP

When you are in the process of ordering the confirmation statement, you will be shown a list of codes and will be asked to tick the SIC Code that applies to your company.

Our Belize International Bank Account is fast becoming one of our most popular choices for clients with international banking requirements.

Due to the increasing popularity we have decided to offer all our existing and new clients a 10 % discount on the bank account introduction service throughout the month of February 2023.

Offering a full range of traditional and none traditional banking services with a range of currencies available. The account opening is simple and there are many advantages, you can find out more here.

The Company Diary allows you to view a list of companies incorporated via our system and view important filing dates such as:

- Confirmation Statement

- Accounts

- Registered Office

Confirmation Statements

- These are due each year after incorporation.

- Confirmation Statements can be filed before the due date.

- If a Confirmation Statement is filed late or not filed at all, the company is likely to be struck off.

Accounts

- These are due each year, on the last day of the month of incorporation.

- Accounts may be filed up to 9 months after the due date.

- If your company is dormant you may file Dormant Accounts through our system.

Registered Office Address Service

- Registered office is due for renewal 1 year after purchase.

- If a registered office is not renewed by the due date, the address will revert to Companies House default address and the company would no longer be in good standing.

UK and Offshore Shelf Companies

We can offer Shelf Companies in England and also overseas. A great benefit of a Shelf company is it enables your business to appear more trustworthy, your suppliers and clients are likely to have more confidence in businesses that have a longer operating history. Also it can save time compared to forming a company from scratch.

We can offer a shelf company in the following jurisdictions:

- England

- Ireland

- Seychelles

- Belize

- Panama

- Sweden

- ST Vincent

- BVI

- Marshall Islands

You can view more information by clicking here.

A Certificate of Good Standing is an official document for UK companies which is obtained from Companies House.

The certificate confirms that your company is in good standing with the Company Register, has been in continuous unbroken existence and has filed all the annual requirements.

When placing your order with CFS, you are able to specify what information you would like on the Certificate when in the process of placing your order.

We are also able to offer a standard and expedite service on this additional service.

A Registered Office is an official address of an incorporated company and is publicly available. It is a legal requirement to have a registered address for your business and the address must be within the UK. CFS Formations is a Registered Office Address provider. We have a variety of addresses available, including services whereby you only receive official government letters and a service where you can receive all letters for your company.

A Correspondence Address, is an official address that all company directors are legally required to have when they are appointed to a UK Company. This is an address you can be officially contacted at and does not have to be located in the UK. The address details are available to the public and are displayed on the public records.

Kindly note that our Correspondence Address services can only be used if the company is also using our Registered Office Address service.

For your convenience, CFS will send filing reminders for UK companies via email to notify you in advance when your confirmation statement and accounts are due.

We are more than happy to assist you with filing your confirmation statement and company accounts. You are able to view these services on our website underneath ‘UK additional services’.

It is a legal requirement for UK companies to file their confirmation statement and accounts each year.

Filing late or failing to file will incur penalties from Companies House and the possibility of your company being struck off the register so, it is essential that you are up to date with your filings.

All UK Companies are required to file a confirmation statement on the anniversary date their company was incorporated.

For example, if your company was incorporated on the 20th October 2022, the confirmation statement would be due for filing on the 20th October each year unless you have changed the filing date.

Our Company Manager facility is linked directly to Companies House, allowing you to obtain recent information on your company. You can also easily make changes and complete the yearly filings.

Companies House do not allow you to file the confirmation statement until the due date.

Filing the confirmation statement can easily be processed via our company manager. You can also choose to file the confirmation statement before the due date and our system will automatically hold this until the due date. This ensures that the confirmation statement is filed on time and therefore, reduces the risk of your company being dissolved.

You can file the confirmation statement through our company manager for a price of: £15.00

To proceed with the filing, please click here.

Our comparison page is really helpful when choosing an offshore jurisdiction and tax on the jurisdiction. As a Formation Agent we are unable to give Tax Advice, however the comparison table does provide lots of information you may need. This page allows you to view the different local taxes, corporation tax rate and more.

Our offshore specialists are on hand to discuss your individual requirements and provide detailed information on the company formation process.

You can view the comparison table by clicking here:

Welcome to our newest employee Kyra!

Kyra joined the team in August 2022 as a UK Business Administrator.

Whilst currently completing her qualification in Business Administration Kyra will be focusing on UK orders and working within our UK Business team.

We asked Kyra:

What is your favourite thing about working at CFS Formations?

I enjoy working with such a friendly and supportive team and having the opportunity to learn new things every day!

We also asked Kyra what she like's doing in her spare time?

I enjoy spending time with family and friends and travelling to new places!

How to order an offshore company

We offer over 20 different jurisdictions to form your offshore company.

Once you know which jurisdiction to you require we have an easy online order form unique to each jurisdiction. You can find more information here

Once you have placed your order you will have a dedicated accounts manager who will deal with your order from start to finish.

You will need to create a username and password then just click Buy Now on the required service.

Our team will always be able to assist if needed by telephone, email, live chat or WhatsApp.

We are delighted to announce that we are now offering a new business payment platform, they are powered by Pervesk UAB which is an electronic money institution authorised by the Central Bank of Lithuania for the issuing of electronic money and payments.

The Payment Account can be opened for Companies registered in the UK and most EU countries. Offshore Companies may also be considered dependent on a full risk assessment and compliance checks.

We work closely with our Banking Partners to ensure we provide you with the best service.

If you would like more information please click here.

Help and Guidance Page

We have a dedicated page on our website which will answer a lot of your questions, it also has additional information about the services we offer.

You can find our Help and Guidance page on the following link:https://www.cfsformations.com/help-guidance/apostille-and-legalisation/blog

This is a question that a lot of clients ask us, which avenue they should go down. With this being a decision that most struggle with, it’s good to do some research on what options are available. Obviously, you are the only one that can decide what option is best for you. I hope the information below will give you an idea on what options are available and the information provided should help you make the right choice.

Advantages of purchasing a Ready Made Offshore Company

- Reliability comes with an aged company, may add commercial credibility which is reassuring for your clients.

- Business and banking relationships are easily established with an older company

- New and existing clients will feel more confident dealing with you as your company will have a history.

- The process is simple and straight forward, Shelf Companies are immediately available to transfer over to you to begin trading with the company

Advantages of an Offshore Company Formation

- Usually cheaper than purchasing an existing company

- You can choose the exact company name you require without having to change the name of the company

- You are shown as being the owner of the company from day 1 of the registration

- You can choose exactly how you wish the company to be registered

- There will be no previous officers within the company – the registers of the company will show you only as being Director / Shareholder

- The shares for the company will be organised exactly how you wish them to be

Advantages for both company choices are shown above, however the final decision would depend on your requirements and this is totally your choice.

If you would like to create a Non-Trading, Dormant Company or wish to Reserve a Company Name, then our Reserve a Company is just for you.

Our Reserve a Name service registers the name of your company at Companies House preventing anyone else from using or trading with that name.

You will not need to provide any company officer details as the company is formed using our Registered Office and with us acting as Director and Shareholder of the company. All we will require is your chosen company name for us to reserve it for you, plus your contact details so we can contact you to renew the company.

You are not allowed to trade with a reserve a name company, it is created as a non-trading dormant company, just to protect the company name for you and to prevent another person from trading with your chosen business name.

At any time, should you wish to start to trade with the company, just contact us and we can simply and quickly transfer ownership over to you. There is an administrative charge for us to transfer the business ownership over to you.

Every Limited company registered in UK is required to have a UK Registered Office Address. Our company offers a Registered Office Address service for those clients who do not have a UK address or do not wish to have their residential address details on public records. Our Registered Office Address service is valid for a period of 12 months and will show on public record and with UK HMRC.

The Registered Office Address must be kept up-to-date. If you use our Registered Office Address, it is necessary that the service is renewed on time every year. If the service is not renewed, the Company will no longer receive any statutory correspondence, and it could affect the company’s status of good standing.

Learn more about how our registered office address works.

When forming a UK company you will need to provide information on who the Shareholder(s) of the company are. Each Shareholder can hold different percentages, rights and share holdings.

If a change of Shareholder has taken place within the company you will need to ensure this information is also updated at Companies House. This does not need to be done straight away, it can wait for the next Confirmation Statement to be due.

We can assist with updating the Shareholder, the price is 28.00GBP.

All companies within the UK are required to submit accounts with Companies House on a yearly basis whether they are dormant or trading.

If the company has traded, you will be required to file trading accounts to prove that the company has trading activity.

To file the company accounts we require three sets of the original signed documents sending to are office address. We will then submit the accounts on your behalf and keep you updated throughout the process.

It usually takes around 5 working days for the company accounts to be accepted.

Whilst we are unable to prepare the actual trading accounts themselves, we can offer a free UK Accountancy Referral who will be able to assist you with preparing the company accounts.

When forming a company and choosing your new company name some words can be considered sensitive by the UK Company Registrar.

Sensitive words are nouns that can be deemed as misleading or offensive. They could also be linked to certain government organisations.

It does not mean that you are not able to use the sensitive word it just means supporting documentation may be required.

Our system with automatically check your company name when you start the incorporation process to see if any words are believed to be sensitive.

We also have a list of sensitive words available on our website. You can view here.

All Companies are registered with HMRC and receive a Company Tax Return reminder on a yearly basis. However, if your company is dormant, you are not required to file these and should mark your company as dormant.

Failure to file your Company Tax Return on time can result in your company receiving a penalty. Therefore, if you have a company that has not traded it is recommended that you mark it as Dormant with HMRC as soon as possible.

We are able to assist with marking your company as dormant for a price of £59.95. This usually takes approximately 5 working days. This service can be ordered through our website under UK Additional Services - HMRC Tax / VAT Services - Mark Company as Dormant with HMRC.

Once your Company has been marked as Dormant, we will send you an e-mail confirmation of this. You Should mark your company as dormant every couple of years.

When your company accounts are due, you will also be required to submit dormant/non-trading accounts. We are able to assist with this for a charge of £40.00. This service can be ordered through our website under UK Additional Services - Confirmation Statements / Accounts - Filing Dormant Accounts with Companies House.

If you require any further information or have any questions, please do not hesitate to contact us.

We are delighted to announce that we have taken on a new UK Based Financial Institute that accepts Crypto Currency. The accounts are regulated by the Financial Conduct Authority, FRN 948213, under the Payment Services Regulations 2017 as an Authorised Payment Institution.

They provide payment services to customers in our target markets, such as technology and gaming. They are one of the leading payment service providers focusing on these industries.

The Payment Accounts can be opened for Companies registered in the UK and most EU countries.

We work closely with our Banking Partners to ensure we provide you with the best service.

If you would like more information please click here.

We are pleased to congratulate Laura on her first year of service with CFS International Formations.

Laura is one of our UK Business administrators within our professional UK and Offshore teams.

Laura Commented:

“I have thoroughly enjoyed working for CFS for the past year. I have learnt so many great skills and knowledge and I look forward to developing my understanding in the upcoming year.

I am so grateful for the opportunities that CFS have provided me with, and every day in the office is different and provides me with a sense of achievement that I have never experienced”

Well done Laura for all your hard work and dedication to CFS over the last year.

We offer a variety of packages when incorporating a UK company.

We have created a Help and Guidance Page to assist you with choosing the right package.

Our packages are tailored to suit your exact requirements. Prices start from 27.95 GBP, for our most popular E-Mail Package.

This Package includes a wide range of services: Free Bank account referrals, 3 Months Free Accountancy, Emailed Official Company Documents and much more.

https://www.cfsformations.com/help-article/uk-incorporations-and-types

The page provides you with benefits and a breakdown of each package.

When going through the UK incorporation process, you are able to upload your own Articles of Association free of charge!

This option is available during the incorporation process and is simple and straightforward to use.

When uploading the file, please be aware that the file you upload will be the document that is submitted to Companies House and will not be edited or formatted by CFS. There is no requirement to upload the Memorandum with the Articles file as this is automatically generated when the company is submitted for incorporation.

Please ensure the file is in PDF – if you have a word document, you should be able to save this document as a PDF

If an incorporation is rejected for any reason and you are changing the name of the company, please ensure you change the name on your Articles.

If you have any questions or would like to discuss this further, please do not hesitate to contact us.

Due to the many benefits, like privacy, tax optimisation and ease of management offshore company formations have become a popular choice for many clients.

It can seem like a daunting process and some people find it hard to know where to start. This is where CFS Formations can assist. As a highly recommended service provider for offshore formations we provide a hassle free and effective solution for your offshore requirements.

Our comparison table enables you to easily compare all of our offshore jurisdictions in one place ensuring you choose the jurisdiction that is right for your business needs. Our offshore specialists are on hand to discuss your individual requirements and provide detailed information on the company formation process.

You may wish to also read our information page ‘How to get started – Offshore Company” which you can find by following the link: https://www.cfsformations.com/help-article/starting-an-offshore-company

Keeping your offshore company in Good Standing is highly important to ensure you do not receive unnecessary penalties. Offshore Companies should be renewed with the authorities where the company is registered on a yearly basis, by doing this your company will remain in good standing.

The yearly renewals will usually cover the government fees, the registered office fees and registered agent fees for the company.

If you fail to pay for the yearly renewal, then penalties may occur and the company could potentially be removed from the register.

To help take away the pressure of remembering the yearly renewals, we do send courtesy reminders six weeks before to arrange the payment for the renewal. However, please note that it is the Directors responsibility to ensure that the Company is in good standing.

At CFS, we have a range of ready-made UK companies available to purchase, with incorporation dates ranging from 2012-2022.

Here are a few reasons why people choose a Shelf Company:

- Boost your business with an established company

- Establish business relationships easily

- Gain confidence from customers

- Simplicity – the process is simple and straight forward.

We require you to complete an online order form with the new company details including directors, shareholders, business activities etc. Once we have received these it usually takes around 24-48 hours to be accepted at Companies House.

You are able to view a list of our available Shelf Companies here.

On our website you have access to your Company Manager. This can be found on your dashboard when you log in. This not only allows you to file any changes to officers and confirmation statements, but also allows you to see the filing history of your company on your dashboard. Alongside this, we also offer a service which allows you to download any filed company forms for a small price of only £3.99!

As a CFS Formations customer you can take advantage of the simplest UK and Offshore company formation process and honest, upfront pricing. Here at CFS we are proud of our competitive pricelist with a ‘no hidden extras’ approach.

Our team pride themselves on the fantastic customer service they offer, we are incredibly passionate about the quality of our service and of our customer feedback, as shown by our excellent reviews and ratings. We are a committed team who are here to help you with all of your business needs. We are dedicated to meeting your requirements and exceeding your expectations. We are committed to maintaining the highest possible standards for our customers and do anything we can to ensure your business with CFS is to the highest satisfaction.

CFS have over a 100 years of combined expertise forming companies and providing corporate and secretarial services that help thousands of our clients grow their businesses each year.

A UTR (unique tax reference) number is a 10-digit number issued directly by HM Revenue and Customs (HMRC). They are completely unique to each and every UK taxpayer and help HMRC to identify them within their systems.

HMRC issue UTR Numbers to individuals, companies, partnerships, trusts and other types of organisations. When you register with HMRC, they will usually issue your UTR number automatically.

If you lose your UTR number, we able to re request this from HMRC for you for an additional fee. It usually takes around 15 working days to be issued by HMRC and is sent directly to the company’s Registered Office Address.

In an effort of continuous improvement and compliance with the international regulatory standards all Seychelles Companies are required to comply with the International Business Companies (Amendment) Act, 2021. The legislation now requires all companies to keep their accounting records at their registered office in the Seychelles.

In view that the majority of IBC’s operate outside of the Seychelles, the 2021 amendments means that the accounting records should be produced 2 times per year and held at the registered office address in the Seychelles.

The accounting periods are to run from 1st Jan to 30 June and from 1st July to 31st Dec.

The accounts should be sent to CFS by the 21st of either July or January.

Filing late or failing to file will incur penalties which will be a minimum of £10,000 so it is essential that you are up to date with your filings.

If your company is dormant all that is required is the completion of one document and no further information will be required unless the company commences trading.

The new changes are to help enhance and improve the provisions already in place with regards to transparency within the Seychelles.

If you would like more information about the recent changes please contact our specialist offshore team: This email address is being protected from spambots. You need JavaScript enabled to view it.

At CFS we offer multiple registered office address services. By purchasing a registered office address you are protecting your identity and keeping your personal address private and confidential. We now offer all clients the option to receive your post scanned. This means that we will scan your post via email. This is completed on a daily basis when the mail arrives, not only this, but the scanning service is totally FREE. This means you will have peace of mind knowing any mail is forward onto yourself on the day of arrival without the worry of any repeated costs.

What is a Dormant Company?

A Dormant Company is a company which is not Trading/no longer Trading. Your company will be deemed dormant if it’s had no account transactions or trading activity. HMRC would consider this type of company to be dormant for Corporation Tax purposes.

Do I still need to file Accounts and Confirmation Statements?

Yes, by having a Dormant Company you do still need to file your Accounts but they can be ‘Dormant Accounts’ which shows no account activity.

Confirmation Statements will still need to filed yearly.

- Filing Dormant Accounts: 40.00GBP

- Confirmation Statement 28.00GBP

Can I start Trading if my company is already marked as Dormant?

You can change the status of your company from Dormant to Trading. HMRC will need to be informed by yourself your company is now ‘Active’. This can be done via HMRC online portal.

At Companies House you can also change your SIC Codes from Dormant (SIC Code 99999) to a trading SIC code which applies to you.

File Trading Accounts at Companies House within the 9 month period.

A WebFiling code also known as authentication code is a unique digital password for your UK Company which consists of a mixture of six numbers and letters.

We will provide the code to you via email as soon as the company is incorporated. Your webfiling / authentication code allows you to file documents electronically for your company. It is also a security measure for you company as it stops unauthorised filings.

If you are unsure what you company’s website code is we are able to assist you in obtaining this information. Please contact our team for assistance.

Welcome to our newest employee, Leon,

Leon is our most recent recruit joining our team as ICT support.

Whilst he completes his qualification as internet communications technician, he will be working alongside our IT team in ensuring all aspects of our IT systems are kept well maintained and up to date.

We asked Leon, what is your favourite part about working for CFS?

I enjoy working for CFS as they are a great, friendly, well supportive team of employees, I see this opportunity as a way to contribute to an exciting company.

We also asked, what do you enjoy doing in your spare time?

In my spare time I enjoy spending time with my family, friends, and walking my two dogs. I also enjoy regularly going shopping, travelling and eating out.

Welcome to our newest employee Laura!

Laura joined the team in May 2021 as a UK Business Administrator.

Whilst currently completing her qualification in Business Administration Laura will be focusing on UK orders and working within our UK Business team.

We feel Laura has already made an impact on the team productivity and customer care.

We asked Laura:

What is your favourite thing about working at CFS Formations?

I love working for CFS as every day is different. Everyone is extremely supportive and friendly! I'm enjoying developing my skills and the sense of achievement I feel after each day.

We also asked Laura what she like doing in her spare time?

In my spare time I enjoy socialising with my friends, spending time with family and going on lots of shopping sprees!

Welcome our newest employee, Laura joined the team in December 2020 as a UK Business Administrator.

Laura is currently focusing on UK orders, working with our admin team. Laura is working very hard and is a great asset to our team.

We asked Laura:

What is your favourite thing about working at CFS Formations?

I love working for CFS as every day is different and everyone here is so supportive and helpful! I enjoy being busy and I look forward to growing my knowledge and develop my skills further!

We also asked Laura what she like doing in her spare time?

In my spare time I enjoy socialising with my friends, travelling to new and exciting places and I am a shopaholic!

We are pleased to congratulate Lucy on her first year of service with CFS International Formations.

Lucy is one of our UK and Offshore Business administrators.

Lucy Commented:

“It has been great working for CFS for the past year.

I have learnt so many great skills and gained lots of knowledge in UK and Offshore Formations.

I enjoy the busy environment and that every day is different.”

Well done Lucy for all your hard work and dedication to CFS over the last year.